您现在的位置是:Fxscam News > Exchange Traders

The caution behind the soaring Bitcoin: Active investment in Asia draws risk attention.

Fxscam News2025-07-22 08:09:54【Exchange Traders】2人已围观

简介Regular foreign exchange platform app rankings,Rhinoceros Smart Investment app latest version,Recently, the sudden crash of virtual currencies led to Bitcoin briefly falling below $65,000, with

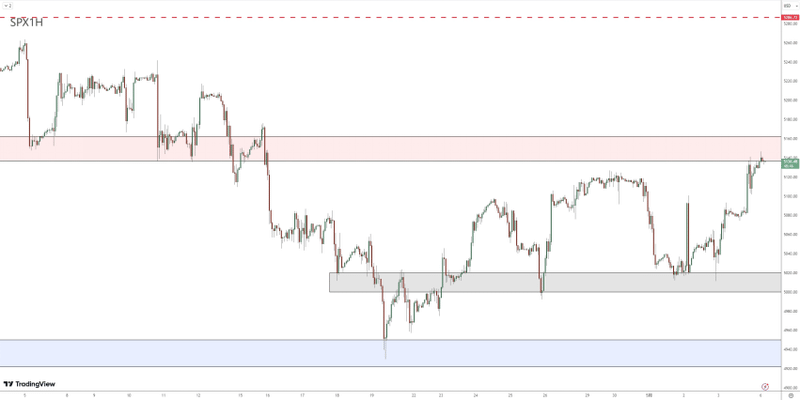

Recently,Regular foreign exchange platform app rankings the sudden crash of virtual currencies led to Bitcoin briefly falling below $65,000, with an intra-day loss of over 6%; at the same time, the price of Ethereum plummeted by as much as 9.77%. The sharp decline in Bitcoin prices triggered a massive wave of investor liquidations, with CoinGlass data showing that in just the last 24 hours, 166,000 investors were liquidated, totaling a loss of $532 million.

It is understood that the sharp drop in Bitcoin prices was mainly influenced by two factors. First, the recent proposal by the U.S. government to tax cryptocurrency miners triggered market concern and panic, leading investors to sell off cryptocurrencies such as Bitcoin en masse. Secondly, the latest inflation data released by the U.S. exceeded market expectations, heightening concerns about inflation and making investors more cautious towards risky assets.

Analysts have differing views on the future trend of the Bitcoin market. Some analysts believe that the price of Bitcoin has fallen to a low level and now has the potential for a rebound, possibly leading to a short-term technical rally. However, others believe that with the U.S. government's increased regulation of the cryptocurrency industry and ongoing inflation pressures, downward pressure on Bitcoin prices will continue, with further declines possible in the future.

Meanwhile, in the field of artificial intelligence, there have been a series of significant developments recently. According to industry news, several well-known technology companies have launched a new generation of AI products and technology applications, covering various fields such as healthcare, finance, and transportation. The introduction of these new technologies will further promote the development and application of AI technology, bringing more innovation and opportunities to related industries.

In summary, the investor liquidation events triggered by the Bitcoin crash were mainly affected by favorable policies and inflationary pressures. The future trend of the Bitcoin market remains uncertain, requiring investors to carefully manage risks. At the same time, the development of the artificial intelligence field remains vibrant and warrants close attention from investors.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(8474)

相关文章

- Bovei Financial Limited is a Fraud: Avoid at All Costs

- The central bank issued 60 billion yuan in offshore bonds, signaling exchange rate stabilization.

- Japan's salary growth peaks in 32 years, boosting rate hike hopes and yen strength.

- The Fed may cut rates by 75bps, boosting U.S. stocks with global trends and territorial expansion.

- Industry Trends: Italy's CONSOB Bans 5 Websites Including FP Invest, Totaling 945!

- Morgan Stanley: The dollar’s gains are priced in; downside risks ahead—sell.

- The yen nears 155, with a 70% chance of a January Bank of Japan rate hike sparking market buzz.

- Pound’s plunge sparks panic, with traders betting it will drop below $1.12 to a record low.

- A Day in the Life of a Day Trader

- Japan revised Q3 growth up, sparking rate hike speculation, but weak consumption raises uncertainty.

热门文章

- Market Insights: April 7th, 2024

- UK Chancellor calls for closer EU ties, Eurozone confidence drops, dollar rises.

- Global Markets Surge Amid Volatility: Rate Cuts Drive Fluctuations, Interest Rate Outlook Key

- The Fed may cut rates by 75bps, boosting U.S. stocks with global trends and territorial expansion.

站长推荐

Market Highlights on November 20th

RMB fluctuations reflect a stronger dollar and global uncertainties, but recovery supports stability

Trump's testimony causes fluctuations in inflation expectations.

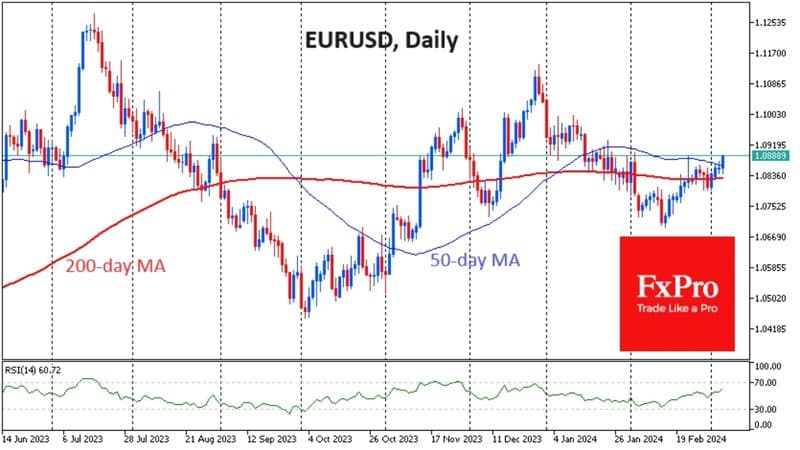

EUR/USD rebounds as German inflation eases, ECB doubts, and dollar pressure persist.

LTG GoldRock Trading Platform Review: High Risk

Gold prices hit a record high, potentially reaching $3,000 next year.

Former BOJ Official: Trump Policies Add Uncertainty, Rate Hike May Be Delayed to March

The rupee hits a historic low as interventions fail to offset slowing growth and uncertainty.